Walk down the street today and eight people out of every ten you ask will tell you that, at the moment, it’s all too easy for multinationals in the UK to avoid paying tax. That’s what a recent ComRes Poll for Christian Aid says. The poll goes on to observe that eight and a half out of ten individuals regard it as unfair that they have to pay their taxes whilst multinationals seem to avoid having to pay theirs. But only one and a half would agree that the fact multinationals are acting within the law means there’s no moral issue at stake.

What use can we make of these data, those of us who work in the tax arena? Is it enough to adopt the position that, as for example Prof Judith Freedman has argued, tax is uniquely an arena in which there is no place for morality. As she puts it: “how much tax should be paid is not a question of moral intuition but a question of what is imposed by law.”

To find the answer to this question, it seems to me, one must start with the “we”. Different groups of people – advisers, businesses, investors, consumers, voters, policy makers – all consider the moral aspect of taxation. But all in different ways.

But before turning to consider the uses made of morality by these different participants in the debate around the relationship between tax and morality, it might just be useful to start with a truism: that which is legal isn’t always moral. Discrimination on the grounds of “colour” (to use the language of the Act) did not become immoral only on 8 December 1965 when the first Race Relations Act received Royal Assent.

I start with that truism because it is only if we lose sight of it that we can regard the question ‘Does XCo wrongly avoid tax?’ as properly addressed by the response ‘XCo complies with all relevant tax laws in all the jurisdictions in which it operates’. It is only if one loses sight of it, too, that one can conclude (against the evidence – which I shall go on to discuss) that there is no use to which morality can be put.

What of us, the advisers? What part does morality play when we exercise that function? No one, you may well say, comes to a tax adviser for a homily. We lack – most of us, anyway (Mike Truman ‘Emeritus’ Editor of ‘Taxation’ is a Licensed Lay Minister) – the qualifications. What we provide is a pure technical view: the tax result produced by a transaction.

However, even this, the apparently easiest of statements elides a number of difficulties. Advising a client as to his prospects of succeeding in litigation, I would be heavily influenced by my assessment of whether his use of a particular relief was pro- or anti-purposive. That technical assessment of prospects would map closely to my view of the morality of a transaction that accesses a relief provided for by Parliament. And not only mine: as I have observed elsewhere, “Judges do occasionally articulate their instinct to fairness against the grain of legislation”. Or as Graham Aaronson QC put the matter in his Report of the GAAR Study Group: “Judges inevitably are faced with the temptation to stretch the interpretation, so far as possible, to achieve a sensible result.”

As a litigator, I try to assess whether the way in which a judge might be persuaded to view the tax effect of a particular transaction will be regarded by her as “sensible”. That assessment, too, often maps closely to my assessment of the morality of that effect. And the task before me if I am advising pre-transaction is an identical task. It is only if I assess a judge as likely to agree with my view as to how the law applies to particular set of facts that I can advise a client that my view is ‘right’.

However, to focus on the narrowest and most technical aspect of an adviser’s function is to risk ignoring the broader reality. Most of my clients want more than a mere technical assessment. They also want assistance in assessing reputational risks. But I can more easily address that facet of the debate around tax and morality if I wear another hat: that of the CEO.

It is a commonplace that reputational issues are of increasing concern to businesses. Three quarters of CEOs surveyed by PWC agreed it was important that their company was seen to be paying its ‘fair share’ of tax. And four-fifths said that tax was moving up the corporate agenda. What is particularly revealing about this analysis is that CEOs, like individuals surveyed by ComRes for Christian Aid, understand that the debate about good tax practice has moved beyond achieving mere compliance with rules which no longer work as they should. In that PWC survey, 65% of CEOs recognised that “the international tax system hasn’t changed to reflect the way multinationals do business today.” That sophisticated participants such as CEOs, too, hold these perceptions should stand as counterweight to any temptation to disregard the results of the ComRes survey as merely the product of public ignorance.

Why should businesses hold these views? There is a variety of, on analysis, discrete concerns. Not all will be present for all types of businesses. But they all tend in the same direction.

Businesses – and especially those doing or hoping to do business with Government – often regard the retention of a Low Risk rating with HMRC as of value. I am aware of instances where clients have chosen not to litigate cases, even cases entirely outside the avoidance sphere, because of a perception that to litigate would jeopardise that rating. And in the avoidance sphere Government has, of course, explicitly encouraged this tendency through its procurement policy.

But there are far from the only points at which tax and morality intersect for those running businesses. The effects of the rise and rise of the Corporate Social Responsibility agenda on tax behaviour have been magnified by an increasing public interest in tax. These two distinct features have created obvious challenges for, in particular, consumer facing businesses.

But what of B2B operations? These are, of course, less susceptible of consumer boycotts and, it is fair to say, can enjoy aquiet the fiscal fruits of that type of planning the merits of which can be expressed simply as ‘lawful’. But not too fast. We can all think of a particular professional services firm which has become the unwitting – and many would say undeserved – poster-child for particular types of tax planning involving one of the smaller members of the European family.

Moreover, management’s stance on tax is plainly a matter of concern to institutional investors. On 4 November 2014 the Financial Times carried a terrific piece ‘Aggressive Tax Avoidance Troubles Large Investors’ revealing the tax concerns of institutional investors. These funds are concerned at the reputational impact for them of investing in companies with “aggressive” tax policies and they are concerned at the sustainability of the post-tax profits those policies deliver. The conjoint effect of those concerns is that certain fund managers regard a disclosed low tax rate as an investment red flag.

If, as the Financial Times argues, we do reach a point where the post-tax income gains of certain types of tax planning come to be appreciated by business owners as delivering a negative hit to the capital value of their businesses then us advisers really are going to need to expand our skill-sets

For the consumer, the equation is a simple one. The ComRes poll reveals that a quarter of consumers are currently boycotting a company because they perceive it not to be paying its fair share of tax in the UK. And two fifths of consumers are considering doing so. And we don’t need to take the commercial effects of these actions on trust. A recent study for the Oxford Centre for Business Taxation found that:

The evidence suggests that the public scrutiny sufficiently changed the costs and benefits of tax avoidance such that tax expense increased for scrutinized firms. The results suggest that public pressure from outside activist groups can exert a significant influence on the behavior of large publicly-traded firms.

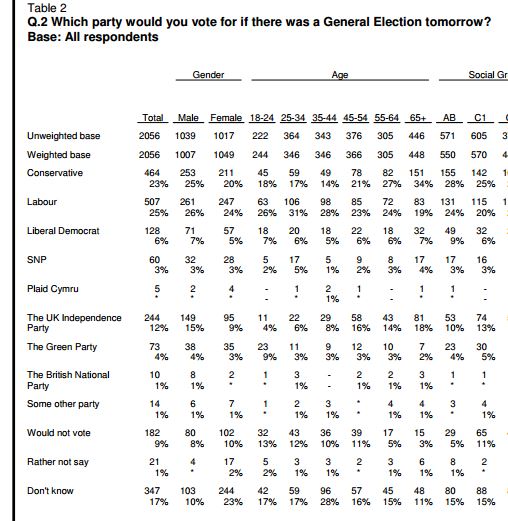

As to voters, there is no doubt that it is the perception of politicians that tax policy is a voting issue. Labour has sought to place public perceptions of Tory tax policy at the heart of the pre-election debate. The Conservatives have responded with measures to tackle tax avoidance by multinationals that have those (remarkably) right across the political spectrum crying that they go too far. Someone has got this political assessment wrong: either the tax commentariat or George Osborne. I know who my money’s on.

Standing back, what does all of this tell us about the question I started by posing? What are the uses of morality in tax? There is, of course, much truth in the notion that morality cannot fix one’s legal liability to pay tax. However, as I have sought to show, that truth is not an absolute one: morality is not irrelevant to the determination of one’s legal liability. And perhaps more important still: it is clearly the case that morality cannot be ignored in determining how much tax it is in one’s self-interest to pay.

The consequences of this discovery pose particular challenges to advisers. We can expect increasingly to be asked the question, ‘what tax should I pay’? This will take many of us into unfamiliar territory.

Morality has its uses. (Forgive me if I interrupt the argument to note that is an assertion you are unlikely to encounter outside the pages of this post.) But as a tool for delivering tax outcomes it is highly imperfect: subjective, imprecise, and enforceable indirectly at best. We should be able to do better.

At the Second Reading of the Race Relations Bill Peter, later Baron, Thorneycroft, argued that one should not legislate against discrimination on the grounds of “colour”; it was too soon. As he put it, “The British people can be led, but they cannot be driven.”

He was right albeit only in the narrowest sense. That there be a relationship between law and morality is a basic requirement of the law. The law becomes difficult to enforce if it is too advanced of morality: this was the Baron’s contention. However, the law falls into disrepair where it fails to keep pace with changing mores. And that, Dear Reader, is what we have here.

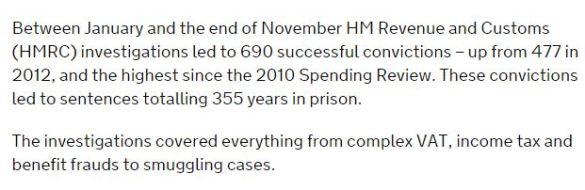

If you add those convictions together you get 2005. Perhaps the other 600 (of the 2,650 referred to) are Jan to Apr 2010 and Apr to Dec 2014. But the real question is whether those are convictions relating to offshore tax evasion or for all offences. Because we’re not told.

If you add those convictions together you get 2005. Perhaps the other 600 (of the 2,650 referred to) are Jan to Apr 2010 and Apr to Dec 2014. But the real question is whether those are convictions relating to offshore tax evasion or for all offences. Because we’re not told.

You must be logged in to post a comment.