Remember shares for rights?

I’ll let Osborne jog your memory for you. Here’s an extract from his 2012 Conference Speech:

This idea is particularly suited to new businesses starting up; and small and medium sized firms.

It’s a voluntary three way deal.

You the company: give your employees shares in the business.

You the employee: replace your old rights of unfair dismissal and redundancy with new rights of ownership.

And what will the Government do?

We’ll charge no capital gains tax at all on the profit you make on your shares.

Zero percent capital gains tax for these new employee-owners.

Get shares and become owners of the company you work for.

Owners, workers, and the taxman, all in it together.

Workers of the world unite.

And the deal would be sweetened by tax breaks. The first £2,000 of shares would be free of income tax. And the first £50,000 of shares free of capital gains tax.

It felt, even at the time, rather ugly. Should we be allowing employers to strip fundamental protections from their employees? Here’s the view of Lord (Gus) O’Donnell, speaking in the House of Lords:

You might think it even worse than that. We weren’t just permitting it. We were, through the tax system, incentivising it. To extend Gus O’Donnell’s metaphor, the rest of us, who fund these reliefs through their tax bills, were encouraging and subsidising the slave trade.

And the amount, and likely beneficiaries, of that subsidy was alarming too. As Paul Johnson of the IFS warned at the time:

it has all the hallmarks of another avoidance opportunity.

And although the cost was said to be fiscal washers:

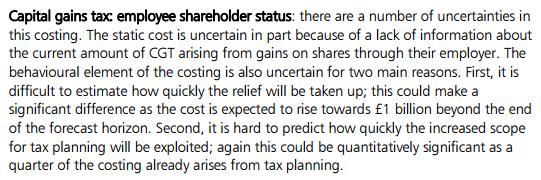

The OBR highlighted that this was only because Treasury was looking at it only over a five year time scale (an oft-resorted to piece of trickery as I noted here). Beyond that timescale, the cost would quickly rise towards £1 billion per annum (real money, even in Treasury terms: by way of illustration about what was expected to be raised by the Mansion Tax):

But nevertheless we shouldn’t worry because:

Now, I raise this because of a chance remark from a friend at a very grand firm indeed who said that he was spending all of his time constructing shares for rights schemes for private equity and MBO clients. But none, he said, for ‘normal’ people.

Let me explain the swizz, and why it’s so valuable.

Forget about the income tax break. £2,000 might be meaningfully valuable to regular folks. But they’re not (as we shall see) the people for whom Shares for Rights was designed for. And it’s not what the OBR was worried about.

There are two other features that enable – you might almost think encourage – the real swizz.

First, the capital gains tax limit isn’t a cap on the amount of relief. It doesn’t give you the first £50,000 of gains tax free (saving you a mere £14,000 in tax). It’s a cap on the value of the shares when you get them.

Second, the shares don’t need to be ‘normal’ shares. They can be so-called ‘sweet equity’: very special shares for the very special people – the ‘value adders’ at the top.

Now. Assume you’re in private equity and you buy a company for £1m. What value might HMRC attribute to special shares which gave you a right to all of the sale proceeds above £1.25m in five years time? Not very much in a world where the Government can borrow over a five year term at an interest rate of only marginally above 1%. Less than £50,000?

Of course, the invariable logic of private equity deals is that you think you’ll be able to obtain high capital growth. Without that belief you don’t transact. If you’re wrong, then of course the capital gains tax break is worth nothing. But if you’re right?

Assume that in five years time you sell the company on for £1.8m. You’ve now got a capital gains tax break on £550,000 worth £154,000.

I’ve simplified my example – but not relevantly so. Here are some other ones from the law firm Bird & Bird. They conclude, tellingly, by asking: “Is this too good to be true?” (I’ll spare you the suspense. The answer is ‘No’. Or what passes for it if you’re a lawyer).

But don’t just take my word (and Bird & Bird’s) that it’s best used by senior management in private equity deals. Look here. Or here. Or here. Or here. Or… well, you get the picture.

Indeed, of course, as Magic Circle firm Linklaters observed, it was never even designed to be used by lower paid employees.

So much for workers of the world uniting. (Although there is a sort of uniting: together the rest of us have to make up the lost tax.)

Oh, and how’s that monitoring going by the way?

Not so good. I couldn’t find a figure – although one is given for other types of employee share schemes. And I did find an HMRC document entitled: “Tax allowances and reliefs in force 2013-14 or 2014-15: cost not know” which contains a reference to, yep:

Gains on disposals of exempt employee shareholder shares

So whilst it could be the £1bn predicted by the OBR. It could be more. Much more. It could be the whole amount being saved in 2016-17 by cutting tax credits.

Despite what Treasury promised, we Just. Don’t. Know.

You must be logged in to post a comment.