A week ago I published a short critique of the Corybnistas’ El Dorado: the £120bn Tax Gap. You can read it here. And you can read here the response to that critique published by Richard Murphy – the man named in the Corbyn Manifesto as being responsible for that estimate. I didn’t respond to Richard; I was happy to leave readers to make up their own minds.

Yesterday’s Times Editorial, too, took issue with that £120bn figure. It said it was a “fairytale” that £120bn could be raised by clamping down on evasion.

Richard Murphy took exception to that editorial here and this, pertinently, is what he said:

And then that suggestion that £120 billion can be collected: no one has said it; least of all me; least of all Jeremy. We have both pointed out the scale of the issue (I have heard him do so). But has anyone said we could get it all? Of course not: I have estimated £20 billion could be raised for an investment of £1 billion, or more. But The Times has just made the claim that all will be collected up.

In other words the ‘useful’ Tax Gap – the bit that it is said is practically collectable – is not £120bn but £20bn.

So three questions emerge: does the Corbyn Manifesto invite readers to conclude that £120bn is available; what is the source of the £20bn; and what sum might actually be available? Let me address those questions in turn.

The Corbyn Manifesto

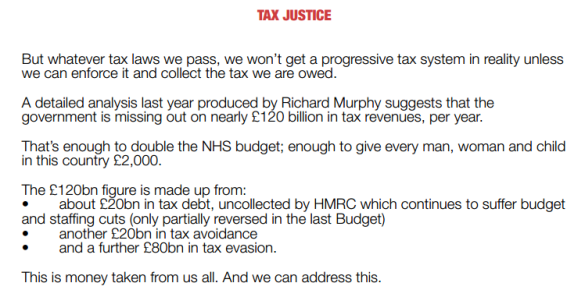

What the Corbyn Manifesto says about the Tax Gap is this:

The Manifesto makes no mention – at all – of the fact that only a sixth of that £120bn is collectable. But it does talk of El Dorado yielding “enough to give every man, woman and child in the country £2,000.” You can make your own mind up about whether the Manifesto did intend to suggest that £120bn could be raised.

The source of the new £20bn figure

Richard and I are friends. But he is a prolific commentator and I do not manage to read all that he writes. So although I have no recollection of any previous work of his calculating a return of £20bn for an investment of £1bn it is possible that I have missed it. I invite Richard to direct me to those calculations. It would be a pity for the country if the Labour Party was invited to choose its leader and commit to a search for that fabled City on the basis of a finger in the air.

What might be collected

Writing in the comments section of last week’s Tax Gap post I observed:

To believe that there are huge revenues waiting to be collected – in other words that the tax gap is more than a KPI for HMRC and is an undeveloped and meaningful source of revenue – you have to swallow some pretty unlikely propositions. £120bn is about a fifth of all tax revenues. There is no political gain for any Government in just leaving that money lying there. It’s about what will be raised from the 40p rate and the 45p rate together in 2015/16. You have to believe that the Tories would rather leave that £120bn uncollected then cut the top rate of personal income tax to 20p. Respectfully, that defies plausibility. You also have to believe that the last Labour Government did this too: £120bn hugely exceeds gross per annum spending on the NHS in the last Labour Government; did Labour really choose just to leave that money lying on the ground?

So enormous was the initial estimate of £120bn that dividing it by six does not diminish the force of these points. £20bn is more than five times gross receipts from inheritance tax; it is a much higher multiple, still, of the yield from the 45p rate of income tax; and it is about seven times the bank levy. So to believe that there is £20bn waiting to be collected is to believe that Osborne has considered whether to abolish inheritance tax and the 45p rate and the bank levy and gain an extra £10bn and decided to do none of these but rather, instead, leave that £20bn uncollected. Is there any plausible world in which Osborne might make that political call?

Richard doesn’t seriously dispute that analysis. His view is that Osborne has deliberately made that policy choice. Here’s what he said on twitter:

And you either agree with that or you don’t. There’s no reasoning you out of it.

Now there is a serious argument that the Conservatives have under-invested in HMRC. FTE staff numbers are down by well over a third from 2005. And the Department is not protected against further cuts. It’s a peculiar choice to slash investment in your only revenue raising department at the same time as you seek to grow revenues. But sensibly estimating a theoretical yield from some theoretical extra investment? That’s a bit tough for me. But the fact that, as I pointed out here, the Tax Gap has remained stable in absolute terms (fallen in percentage terms) despite the cut in staff numbers does not suggest that there are huge net yields in store from raising investment.

Follow @jolyonmaughamAddendum

Note. Richard has responded to this post here. He links to his report on the Tax Gap and builds on some 2013 figures from ARC (the Union that represents senior staff in HMRC) which call for an extra £312m of investment that, they project, would deliver £8.26bn of tax (£26 for every £1 invested). You can read the ARC document here. The basis for ARC’s projections are not clear from the document.

Richard goes much further than ARC. He says that, in addition to ARC’s £312m, HMRC should spend a further £1bn which would yield £12 for every £1 invested. And £8.26bn plus 12 x £1bn gets you to £20bn. But no specific case for spending £1bn is advanced and nor does Richard offer any reasoning given for the projected 1,200% return on that £1bn.

Whilst, as my original post made clear, I think there is a strong case for examining the amount invested in HMRC I find it difficult to extrapolate from Richard’s post any evidential rationale for the supposedly realisable £20bn return.

Note

I am not accepting comments that do not make forensic points about the quality of my, or Richard’s, analysis. Where comments contain (but are not confined to) a forensic point I will edit them to remove all but that point and mark them as “edited”.

Pingback: Tax Research UK » How much of the tax gap is collectable?

Unfortunately Murphy’s “work” on the tax gap is of the most basic standard. It takes a VAT gap, multiplies to calculate the size of the shadow economy then just assumes a 40% tax rate to get his 120bn number. It is primitive analysis to say the least.

He claims his number is more accurate than HMRC’s, despite their methodology being more thorough, and vetted by the NOA and IMF (who he also claims support his analysis). Trying to suggest he has made any mistake meets with the simple assertion that he, with a pocket calculator from his garage, can provide a more accurate assessment of tax gaps than a small army of people at HMRC with significantly better data.

[WfT note: Edited]

Like you I find it fantastical that there is £120bn out there just waiting to be collected and successive governments of all persuasions have done nothing to collect it whilst apparently being willing to suffer howls of protest from the electorate when making comparatively small actual tax increases. And if there is £120bn out there, why is there only a realistic prospect of collecting just £20bn of it? You think you’d be tripping over tax gap pounds every time you went outside your house.

Nor to my mind is there any rationale to Richard’s statement that not collecting it is all a ‘neoliberal plot’. A better ‘neoliberal plot’ would surely be for the government to collect tax evaded and ‘aggressively’ avoided and reduce taxes elsewhere by the same amount elsewhere to their ‘business chums in the city’.

[WfT note: Edited]

You say Richard and you are friends. Fine. [WfT note: Edited]

In which case, what attracts you to him so much that you call him a friend?

Jolyon

I admit to some amazement

ARC detailed their analysis

My whole report and its recommendations are the logical argument for my extrapolation

You are ignoring both

I am genuinely bemused by your suggestions: they simply make no sense to me, at all

Where is your argument? I have laid mine out in great detail

Which is a strange think to ask a lawyer

Richard

I note that he’s not saying £8bn + £12bn = £20bn. He works backwards: he supposes £20bn can be recovered, says that includes the ARC’s £8bn, and shows that £20bn is therefore reasonable as it requires only a 12:1 return on his extra £1bn.

I would also question whether investing an extra £1bn is actually feasible. I’m not clear whether Murphy is suggesting that the £1bn is an annual figure or a total one, but even if we assume that it’s £200m a year over the 5 years of this Parliament, then that’s what, 4-5,000 new staff (assuming average cost of £40-50k per head, a mixture of experienced people and juniors) all ready to go with detailed investigation work.

That’s several major accountancy firms’ worth of tax people. I’m not sure the supply is available.

If it’s £1bn a year, we’re talking about the equivalent of recruiting most of the CIOT and ATT in one go… we might even need to get accountants in to make up the numbers!

I agree that HMRC needs more people, and ideally would have much more in the way of resources for enquiries, but I think it needs to build up slowly.

It also needs to have more people just answering phones and doing return paperwork: automation should be replacing these people, but I suspect that the people are being removed before the replacement systems are ready.

I thought I was someone who had a lot of ideas until I encountered Richard. I know that an inevitable consequence of having lots of ideas is that no one will agree with all of them. I also know that Richard has done a lot of extremely valuable and influential work in the tax avoidance and evasion fields. And that’s no surprise – in UK NGO terms, he’s been working on it (along with John Christensen) rather longer than anyone else I’m aware of. He has driven the agenda in some extremely valuable ways. So I’m proud to call him a friend.

I do recall a fairly detailed piece from the US (which unfortunately I didn’t save a copy of so no reference) which argued that there every 1$ invested in tax collection returns $12 so I don’t find Richard using the same 1:12 ratio implausible – at least for ‘low-hanging fruit’. The total amount remains opaque with issues like tax havens complicating matters.

I am suggesting £1 billion a year

You clearly have no clue how HMRC works

It breaks tasks into parts. Some people will need to be know about tax in detail, of course

But many will be relatively easily trained and some will have skills in areas like debt recovery that do not need a CIOT member

But as ever, you completely miss the point

The data is from the USA

The NAO ha suggested HMRC do UK equivalent research

I deal with HMRC on a daily basis, which I suspect you do not.

I know perfectly well that HMRC breaks tasks into parts. This is, for example, why I have just had to wait over a year for a response on one case – the officer dealing with the enquiry has had to refer to a technical department, which has had to refer on, and every dividing line adds delays and confusion. I also strongly suspect that it means that the person giving the opinion doesn’t have the skills or experience to deal with this particular situation: they specialise in one area, but have completely neglected some pretty basic aspects of other areas of tax. Silos are useful, but dangerous if not used properly.

The whole point about trying to recover tax lost though avoidance, evasion – or just plain difference of opinion about how the legislation applies – is that by definition we’re not talking about the easy stuff. It is a lot more complicated and technical than processing PAYE codes, but HMRC even has problems with that , due to inexperience of the people involved, so I am very concerned that dropping in people with simple training will just not get the job done. I don’t normally use juniors when responding to HMRC enquiries, simply because there is nothing they can add to a technical discussion.

The last thing I want as a tax advisor is to have to educate the person who is enquiring into a client’s tax affairs as to how tax legislation works. And the last thing I want as a taxpayer is to have HMRC paying people to do a job badly (and therefore twice or thrice over).

There may be some scope for doing simple reviews to identify unusual transactions, but HMRC tend to automate that these days. What can’t be automated needs technical knowledge – either way, there is little room for the unskilled.

Incidentally, I am not suggesting that HMRC needs CTAs particularly: my reference to CIOT was just to point out the sheer scale of £1bn in staffing terms.

Anyway, this is all quite apart from the fact that a lot of your £120bn seems to be based on “if the law were different more tax would be paid”. That doesn’t need more HMRC staff to address, that needs 650 people in Westminster – who are already in post.

Even assuming Mr Murphy is right that £20bn is available given a bit more effort by HMRC, where does that leave Corbyn’s statement, reproduced above, that the Tax gap is “enough to double the NHS budget; enough to give every man, woman and child in this country £2,000”?

For £2,000 per person multiplied by a population of roughly 60 million is £120bn, not £20bn.

[Edited]

The problem is the Tax Gap is not “low-hanging fruit”. It is, by definition, “the high-hanging fruit” which has evaded picking, involving evasion and aggressive avoidance. Starting off from a staff base of zero, I can well believe that the ratio is 1:12 (or even better). For the Tax Gap, no chance of anything near that.

I read “…if only we were able to recover it” into the quote, so although he does say the issue can be addressed, I don’t read Corbyn as saying that any particular amount is available.

For a bit of further context, HMRC’s ‘record-breaking’ compliance yield in 2013/14 was £23.9bn, up from £20.7bn the year before. So another £20bn would still require near enough a doubling of compliance yield.

The 2015 US Department of the Treasury report on the IRS suggested that an additional investment of $475m in 2015 would yield an extra $2.1bn by 2017. Closer to 4.4 to 1. The 6 to 1 figure was based on ‘full performance’ of those resources at some unnamed future date.

Mind you the initial impact assessment of IR35 in 1999 here in the UK anticipated an extra £300m a year in tax/NIC. Between 2002 and 2008 it raised a total of £9.2m.

And what was the bonanza predicted when Switzerland etc opened their tax doors to the exchequer? Didn’t quite materialise, did it?

Successive governments have invariably overestimated how much tax they will raise by various initiatives by amounts matched only by their underestimation of how much their various vanity projects would cost.

Which is why caution rather than fanciful optimism really ought to be the watchword for politicians and those advising them.

Sorry, the paragraph

“The 6 to 1 figure was based on ‘full performance’ of those resources at some unnamed future date.”

ought to read

“A 6 to 1 figure was then given based on ‘full performance’ of those resources at some unnamed future date.”

If you don’t mind editing the post

To clarify that last reply – edited for reasons I well understand – the Tax Gap, put at its practically recoverable highest by Jeremy Corbyn’s own economics adviser – is not enough to “give every man, woman and child in this country” the £2,000 which Mr Corbyn claims. On Richard Murphy’s own figures the amount is rather under £350.

What happened to Mr Corbyn’s famous straight talking?

The £120bn does though, presumably, mean something to Richard and to Jeremy. Otherwise why use it as your headline figure? Why not mention the £20bn figure in your manifesto at all?

I am particularly interested in the £80bn of evasion. This dwarfs the others.

Why then does the tax campaign community (may I call it that?) devote so much of its time and resource to the relative small beer of corporate avoidance. Let’s be clear, evasion is not undertaken by our large businesses!

Why also do Richard and Jeremy feel that only £20bn is collectable? How much of that relates to evasion? Why is it possible only to tackle such a smallnpropertion of this evasion?

And to be blunt, given that Richard’s £20bn is only an extrapolation of an ARC estimate, with assumption layered upon assumption, should we expect any detailed analysis of these figures at all, be it £120bn, £20bn or any figure?

There’s been a fair bit of discussion on what ARC had to say about reducing the Tax Gap. As the lead author of that paper it’s nice to see people talking about it – even if there is a lot of understandable questioning.

I thought it might help to provide a little more background and some independent cross-checking on the type of analysis undertaken. ARC’s first foray into this area came in 2010 when it launched a campaign designed to get more resources for HMRC in order to bring in more yield. We might want to, but cannot in all conscience, take full credit for the decision to reinvest £917mn into HMRC – predicated on delivering substantial additional yields.

Our recent paper that Richard refers to is also linked below. We looked at three main areas:

• Tackling avoidance and technical tax gaps

• Investment in customer and agent support

• Building future capacity within HMRC

http://www.fda.org.uk/Media/Tax-gap-is-closing-but-further-8-billion-could-be-recouped-by-HMRC-providing-an-alternative-to-cuts-or-tax-increases-says-ARC-Budget-submission.aspx

This was not based on any confidential information but on published date, e.g. HMRC Annual Reports or NAO findings, and was subject to a sense check based on members’ experiences. We were very conscious of capacity issues (e.g. the sort of things that Andrew Jackson has already mentioned) and I’m aware that politicians were also unwilling to “over-invest” just in case the delivery capacity was not there. It was for that reason we said it was a multi-year programme.

The same logic of invest to raise has again been adopted by the Government at the last Budget. In fact, this time they made the commitment before we had the chance to deliver our CSR 2015 submission calling for more investment to follow up on the success of the £917bn! (The issue is now whether the 25/40% cuts are to hit HMRC. If they are, then it will risk delivery of the £7.2bn pledged – there are fewer savings to be made in things like processing or post, digital is well advanced, etc.)

It is very instructive to read the NAO Report on the 2013-14 HMRC Annual Accounts.

(http://www.nao.org.uk/report/her-majestys-revenue-customs-2013-14-accounts-2/; R35)

The following table shows what happened to that £917bn. It also gives an overall ratio of 18:1. Now, some ‘low-hanging’ fruit may have been taken, some avoidance opportunities legislated away or defeated in the Courts, some “schemes” no longer devised and sold, and the demand may have dropped. It might be questioned whether this can be repeated, that perhaps the low-hanging fruit has been taken, or the process improvements are coming to an end. But as someone said the battle for avoidance may be successful, however the battle against all the other vectors continues – evasion, criminal attacks, not taking reasonable care, etc.

Cost and benefit

(original spending review plans)

Investment across SR10 (£mn)/

Yield across SR10 (£mn)/

Projected return on investment across SR10 period

Affluent individuals 17 259 15:1

Wider coverage 548 7,037 13:1

Volume crime 60 930 16:1

Evasion publicity 8 330 41:1

Organised crime 96 4,315 45:1

Avoidance package for

Large Business 25 1,550 62:1

Expanding the use

of debt collection

agencies 101 1,105 11:1

Debt – staff reinvestment 62 918 15:1

Total 917 16,444 18:1

Apologies for the table’s formatting – it just seemed to vanish when I copied it over.

Jolyon, singling out the conservatives for under resourcing hmrc is a bit much if you don’t do the same for new labour and indeed the lib dems. No need to remind you who started as on this path, now is there.

Pingback: Morning round-up: Thursday 13 August - Legal Cheek

Jolyon, I see there has been a further explanation/clarification from Richard this morning. He makes it quite clear that the COLLECTABLE tax gap is only £20bn and he has only ever said it is £20bn. The crucial phrase is “we can address that”. In other words, “we can take steps to close that partially” rather than “we can close that”.

This, however, doesn’t make it better. The Corbynista manifesto highlights the figure of £120bn; I cannot see £20bn. The clear inference is that £120bn can be collected. It wasn’t until you challenged it that this clarification was offered. Jeremy Corbyn has been accepted, whether you agree with him or not, as a conviction politician, a politician of “rare integrity”. Yet this, if not due to rank incompetence, shows him to be misleading at best.

More generally, Corbyn, the Corbynisitas and Corbynomics are a disaster for the country. Look, I am a Conservative, a lifelong tribal Tory. On one level I have thoroughly enjoyed Labour’s pain at Corbyn’s rise. The joke has worn very thin though. It is also a simple fact that, for a democracy actually to function, there must be a functioning opposition, a viable alternative government. The coalition work on the tax gap was driven by the prospect, fear, of being outflanked by the oppostion, the Conservatives’ most uncomfortable three days in the last GE came courtesy of Jolyon Maughem’s work on non-doms. Corbyn promises annihiliation at the hands of the electorate. So there is no alternative government. Understand; Tories can see the problem with this.

Thank you Ironman. That’s very kind of you.

And I think, were the shoe on the other foot, I’d be feeling the same way: a country without a viable opposition is a weakened country. It’s of the essence of power unchallenged to assert itself wrongly. And that’s not an insight confined to those in opposition.

What about your Richard’s assertion that it’s a political choice not to collect the £20bn. What is the basis for this other than a bald (political) point. Whilst George Osborne is Chancellor I suspect he’s not so much of a meddler to stop people in HMRC from collecting money that’s due( otherwise why introduce the APN regime – is this just a sop to the NGO’s etc?

Pingback: Corbynomics and the magic money trees | Richard Angell

I’m not sure that the new legions of Corbyn supporters much care about the fiscal reality though? It seems to me that the middle ground (floating Lib/Lab/Con) voters are totally apathetic to the entire election, which leaves the only section who are either energised and/or engaged being all those on the traditional Labour/Socialist Left of the party who have been marginalised and disaffected since 1994 when Blair took the party helm.

Maybe so; maybe not. But we can only appeal to reason.

Pingback: Hadish Stone – Economic policy

Pingback: Stop cheering, Keynesians | UK magazine – Breaking News, Latest News and Current News from UStoday.org Breaking news and video. Latest Current News:UK, U.S., World, Entertainment, Health, …

Pingback: Corbynomics – meh | Homines Economici

Aren’t we missing something here? Much of the research seems to come from a union keen to safeguard members’ jobs and restore staff (ie member) numbers – fair enough – hence the emphasis on HMRC numbers. But that won’t do it alone, there’ll have to be a tightening of rules, greater power to determine (and get) amounts due, etc. I suspect that’s also part of the bigger calculation. Corbyn’s into jobs, and union votes would be nice for him, so the talk is of jobs; but I imagine (and hope) there’s more to the reasoning than just more staff engaged in the same fruitless pursuit.

Anyone who believes that ‘tax is not collected as a matter of policy… a neoliberal belief in small gov’t’, or that Tory tax policy is driven purely by a desire not to tax the rich, should take note of what Osborne has done to the taxation of carried interest.

Just picking up on Dave P’s comments on union research.

I agree it will have a naturalness focus on its members’ roles. But the summary posted was to address the investment /yield ratio. If you have the time to read the extended version you’ll see it discusses (in less detail) things like supporting the BEPS process, getting the legislation right, investing in IT, and training.

Reducing the size of the Tax Gap will need a whole range of approaches.