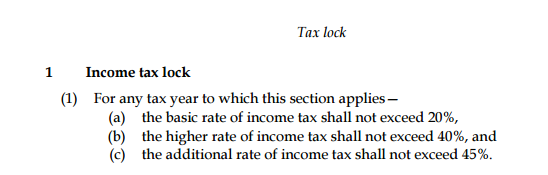

Remember the Tax Lock? I wrote about it here and here. But let me remind you:

It derived from the Manifesto which provided:

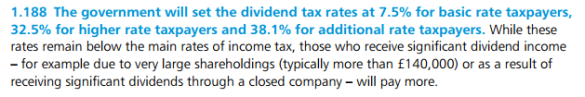

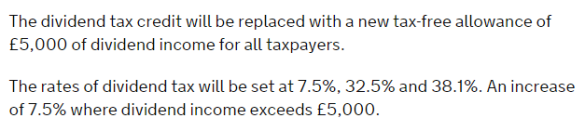

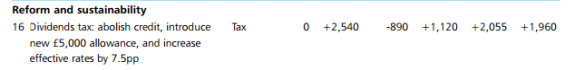

You’ll remember the Budget Red Book published last week which recorded an increase of 7.5% in the rate of tax paid on dividend income above £5,000:

The Red Book was very careful not to describe it as an increase in income tax rates. Osborne, too, skirted around the issue in his budget speech:

At times like this, lawyers always reach for Lord Templeman in Street v Mountford, who famously observed:

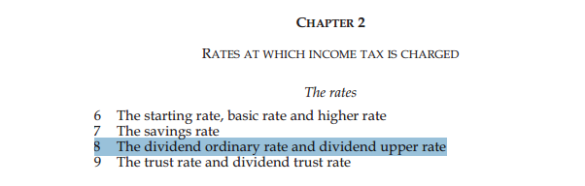

Because, as the Income Tax Act 2007 makes clear, a tax on dividend income is a tax on income:

And an increase in the rate at which you pay tax on dividend income is an increase in income tax rates.

The Finance Bill – published earlier this afternoon – attempts to weasel out of this conundrum by redefining the tax lock:

As redefined it includes some, but not all, rates of tax on income.

But as Gavin Kelly noted in the Observer of the so-called National Living Wage:

Just because I call my cat Rover, it doesn’t make it a dog.

It’s hardly an insignificant increase either, as these yield figures from the Red Book make clear:

Farewell, then, the Manifesto Pledge and Tax Lock: smashed before installation.

(NB: Edited to add Red Book yield figures).

Well, if you were so inclined, I suppose you could say that what has really changed is the abolition of the 10% notional tax credit. Just looking at headline rates, 7.5% is actually less than the current dividend ordinary rate of 10%; the dividend upper rate of 32.5% is unchanged; and only “additional rate” taxpayers have seen a very slight increase in rates, from 37.5% to 38.1%. The heart bleeds.

Of course, there is very clearly an increase in effective income tax rates on dividends. The Convervative pledges were refreshingly simple. Labour were very specific in only making pledges to keep the basic and higher rates of income tax the same (and to increase the additional rate) without mentioning dividends.

If it’s good enough for Osborne, Andrew, it’s good enough for me: “an increase of 7.5%”. For present purposes at least 🙂

The other way of looking at it is to ask whether it raises money and those figures look like 0 +2,540 -890 +1,120 +2,055 +1,960. Figures on page 72 here

Looking at the VAT lock which is more my area, this prevents any increase in the standard and reduced rates, and prevents anything being moved out of the scope of the reduced or zero rates. However, it is silent on the exemptions from VAT, so it seems at least possible that some supplies that do not presently bear VAT could be made to do so.

Yep. Even as originally cast it doesn’t provide much in the way of protection, as I note here

Good to see this concern identified for those taxpayers who will receive sufficiently high dividends to negate the impact of the £5,000 exemption; by my ‘back-of-an-envelope’ calculation, for a higher rate taxpayer, this requires a listed share portfolio of around £480,000 outside their ISA but I stand to be corrected.

PS.I suppose it also ought to be adjusted by the corporation tax reduction as well.

Either your calculation is kaput or HM Treasury’s is because they think the measure is going to yield almost £7bn in the first five years. But knowing you as I do I’m prepared to contemplate the possibility that you might be right and them wrong.

I think both calculations might well be correct; note that I said ‘listed share portfolio’ and I assumed a dividend yield of 3.5% but this might be a tad light. Obviously, for owner-managed companies, different drivers are present, including the tax cost of a dividend.

The fundamental point is that the rise in dividend income tax rates is hugely significant in financial terms. It’s the third biggest tax rise in the budget after increasing insurance premium tax and bringing forward the date on which large groups pay CT (assuming you describe that as a tax rise – I wouldn’t)

You are entitled to disagree with any of the proposals, but I do think its right to apply some intellectual consistency.

You’ve rightly made the point that the “tax lock” only covers certain rates and thresholds, and that there are other ways of (more covertly) increasing tax. And you are right to point to increasing yields to demonstrate it’s a change that results in more tax. But I think if you take that position, it’s hard to argue that moving the corporation tax payment dates forwards isn’t a real tax increase.

I personally think the tax lock is one of the weirdest, most pointless pieces of law ever implement. As you’ve said, it has no practical legal use (as it can be overridden by new legislation), and because of its timing has little political use either. It’s the sort of law that does nothing other than create a noose for the person who has to repeal it – it’s the sort of law you introduce 6 months before an election you expect to lose.

I’m struggling to see the lack of intellectual consistency that you say I’m exhibiting I’m afraid. But the point I’m making – and on which we seem to agree – is that here is an important manifesto pledge which has been broken.

Pingback: Tax Research UK » Some tax law is not worth the paper it is written on, even before it is passed.

Actually I’m hoping the corporation tax cut and dividend tax rise represent the first step towards effective tax transparency (e.g. US ‘S-Corporations’); thereby removing a layer of tax at little or no cost to the Exchequer. One could say corporation tax has already halved from 35% to 18% (for middle age tax advisers) or been cut by two thirds from 52% (for old tax advisers such as me); not that much further to go…….