The Chancellor’s plans to eliminate the deficit were always going to come unstuck.

Do not fear. I do not blog to advertise my lack of knowledge of macro-economics. Why would I, when that market is already so crowded?

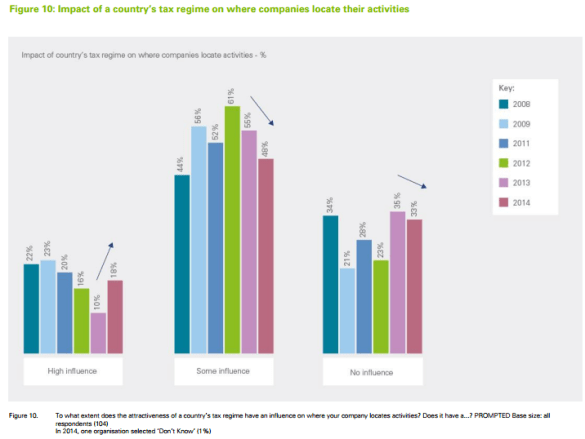

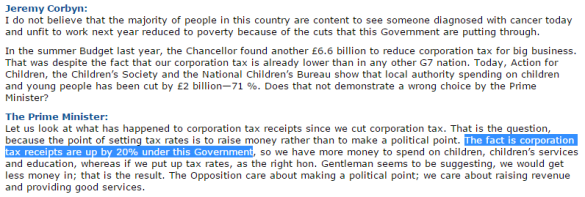

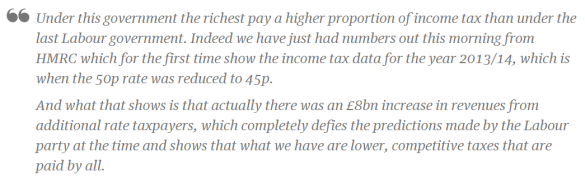

I do not blog today on the effects of cutting public spending on growth. Nor, although previously I have elsewhere, do I mean to point to the consequences of Osborne’s decision to narrow our tax base. Nor, although I will, his relentless focus on cutting tax for corporations – beyond our G20 peers, beyond that which influences their investment decisions, beyond even that which they ask for. Nor, although it is something the OBR has persistently pointed to, will I point to the fact that Osborne’s deficit reduction plans rely in good part on asset sales rather than balancing income and expenditure.

No, the reason why Osborne’s plans were always going to come unstuck is a function of simple arithmetic.

Assume my spending remains constant at 100. To fund that spending I must have receipts, every year, of 100. Over five years to fund spending of 500 I must have income of 500. That five years is important because it’s the time horizon over which we plan our nation’s spending.

If my income is not 100 a year but 85, I have a problem. You might think, and rightly so, that I am 15 short. This Government has been 15 short.

What it has done, to hide that truth, is accelerate a whole bunch of 15s from later years into earlier years to hide the shortfall. Which is fine in earlier years – your budget looks balanced – but it leaves you in those later years with a shortfall of 30: the 15 you had anyway and the further shortfall consequential on you taking 15 from those later years for use in earlier years. Instead of having 85 you’ll only have 70. It’s not that complicated: if you spend tomorrow’s money today, you won’t have it tomorrow.

For a number of years, this is what we’ve been doing. On an extraordinary scale. Did you see those italics? Good, because I’m going to come back to them. And we’re now looking at a whole bunch of 70s.

You don’t believe me? Let me give you some examples. I don’t need to go back too far to justify those italics.

I’ll start with the Autumn Statement 2013. The Chancellor announced “follower notice” provisions which brought into earlier years £670m of receipts from tax avoidance cases that were expected to be won in later years. In Budget 2014, the Government dramatically extended the scope of the follower notice provisions with some “accelerated payment notice” provisions that moved a further £3.9bn from later into earlier years. A few points about these sums: of course, they moved money from later years into earlier years. But they also treated “possible” wins as certain. And they treated one off sums – resulting from a huge stockpile of tax avoidance litigation – as ongoing income.

But Budget 2014 didn’t pull this trick once. It pulled it twice.

Government knew that if you released pensioners from the obligation to buy an annuity from their pension funds and allowed them instead to withdraw cash lump sums they would. And when they did, income tax that would otherwise have been paid later on that annuity would instead be paid earlier, on the cash lump sum. Government would get the tax in the cash withdrawal year – but it wouldn’t get it in the later annuity years.

What was styled ‘pension freedom’ brought £3.05bn from later years into earlier years.

On to that year’s Autumn Statement. If we make a profit in tax year one but have made earlier losses, we can set those earlier losses against the tax year one profit and avoid paying corporation tax in tax year one. Government decided it wouldn’t let banks deduct their earlier losses against all of their tax year one profits: instead it would only let them deduct earlier losses against half of those tax year one profits. This would increase the Government’s take in tax year one but would also, of course, mean that in future tax years banks would have more losses available – because they wouldn’t have been set against tax year one profits. The result would be to increase the tax paid in earlier years and reduce it in later years.

By this mechanic, the Government brought from later years into earlier years the sum of £3.48bn.

In the March Budget of 2015 Government addressed its mind to those who’d already bought annuities. If we allowed them to sell those annuities, the same thing would happen as those who had yet to buy annuities. Those selling them would be in a position to make cash withdrawals giving rise to a tax liability now – rather than a later tax liability on payments under the annuities. This extension of pension freedom dragged a further £820m from later to earlier years. There was also an extension of the accelerated payments regime dragging in a further £550m from later into earlier years.

This all continued after the election. In the Summer Budget 2015 Government advanced the date at which big corporations had to pay their corporation tax. This brought an extra £7.83bn into earlier years. It wasn’t lost from later years – but it was a one off boost which made it look as though we had an extra £7.83bn of ongoing receipts.

In the Autumn Statement 2015 we repeated the ‘advancing the tax receipts’ mechanic, but this time for capital gains tax on residential properties, bringing into earlier years a one-off boost of £1.16bn.

And in last week’s Budget 2016 Government extended the Autumn Statement 2014 restriction on loss reliefs for banks and other companies, bring from later years into earlier years a further £3.36bn.

This isn’t over – the Making Tax Digital project will create an enormous one off boost – quite possibly in the tens of billions of pounds – to public finances in earlier years. This boost will flatter the real condition of public finances but won’t alter the underlying reality.

Even ignoring the Making Tax Digital boost, and only looking back to the Autumn Statement 2013, this combination of measures has brought £24.82bn into receipt for the five year timescale of earlier years. Much of this sum represents a one off boost; much of it will worsen the state of public finances in later years; none of it is repeatable; and all of it is matched against on-going expenditure.

And those later years? We’re looking at them now.

Be afraid.

Follow @jolyonmaugham

You must be logged in to post a comment.